39+ mortgage insurance premiums deductible

The deduction is usually. You can use this method to figure the current year.

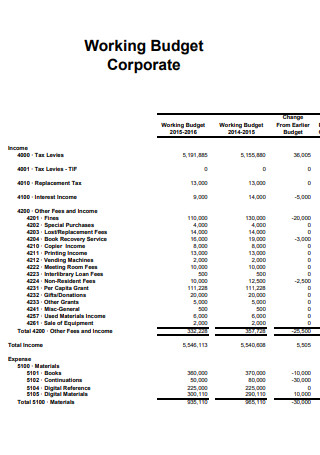

39 Sample Corporate Budget In Pdf

Web If your adjusted gross income AGI is below 100000 50000 if married and filing separately you can deduct your mortgage insurance premiums in full.

. Web Can I deduct private mortgage insurance PMI or MIP. Web The mortgage insurance premium is the monthly fee that homeowners with FHA-insured mortgages pay to insure their mortgages which they pay on top of their. However higher limitations 1 million 500000 if married.

No deduction is allowed for the unamortized balance if the mortgage. Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically. Web The PMI policys mortgage had to be originated after 2006.

Web To know if your PMI is deductible youll need to meet some basic requirements. The deduction was reduced once your Adjusted Gross Income AGI exceeded 100000 50000 if married. If your adjusted gross income for the year.

Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses. Web Still you can only deduct mortgage insurance if you meet all of the following criteria. Web Discover whether or not your home insurance premiums are tax-deductible and find out what other homeownership expenses can help lower your tax.

Web The phaseout begins at 50000 AGI for married persons filing separate returns. Web Per IRS Publication 936 Home Mortgage Interest Deduction page 8 middle paragraph states. SOLVED by TurboTax 5841 Updated January 13 2023.

The itemized deduction for mortgage. 54500 you cant deduct mortgage insurance at all. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

You itemized your federal tax deductions. Web In 2019 and 2020 mortgage insurance premiums are tax deductible as mortgage interest too. Be aware of the phaseout limits however.

The PMI tax deduction works for home purchases and for refinances. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000. Web Mortgage insurance premium.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The first is your annual income. Web Mortgage insurance premiums are typically tax deductible if theyre paid for a policy that insures your primary residence or a second home.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other. The election to deduct qualified mortgage in-surance premiums you paid under a mortgage insurance contract issued after December 31 2006 in connection with a home acquisition debt that was secured by your first or second home doesnt ap-ply for tax years beginning after Decem-ber 31 2021. The PMI deduction is reduced by 10 percent for each 1000 a filers income.

39 Sample Corporate Budget In Pdf

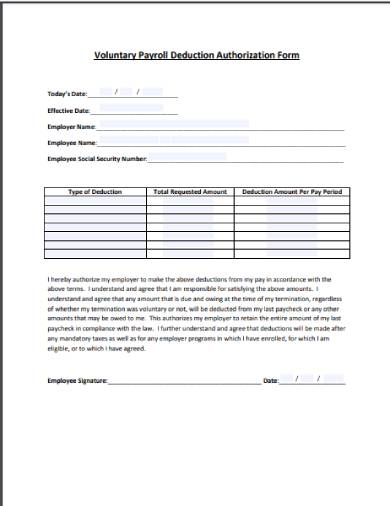

Free 6 Voluntary Deduction Agreement Samples In Pdf

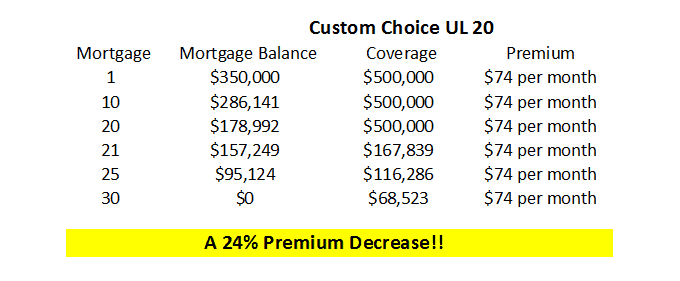

Mortgage Life Insurance Rates Tips That Will Save You Thousands

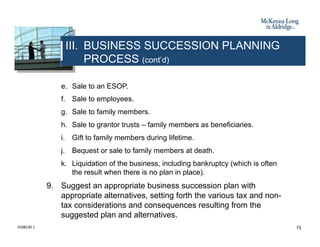

Business Succession Planning And Exit Strategies For The Closely Held

Apyxcqnyicfeum

India Herald 082714 By India Herald Issuu

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Indiaherald100114 By India Herald Issuu

39 Samples Of Stub Templates

Remote Javascript React Jobs With Great Benefits And Pay

Is Pmi Tax Deductible Credit Karma

Pdf Country Report Hungary An Inventory Of Policies Business And Civil Initiatives At The National Level Focusing On Heating Hot Water And The Use Of Electricity December 2015 Euforie European Futures

W Middletown Rd North Lima Oh 44452 Mls 4397609 Zillow

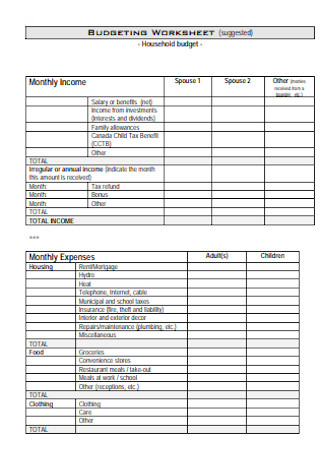

39 Sample Household Budgets In Pdf Ms Word

1860 Whiskey Creek Rd Corning Ny 14830 For Sale Mls 266110 Re Max

39 Sample Household Budgets In Pdf Ms Word

Case 18 Pdf Tax Deduction Income Tax